betterment tax loss harvesting wash sale

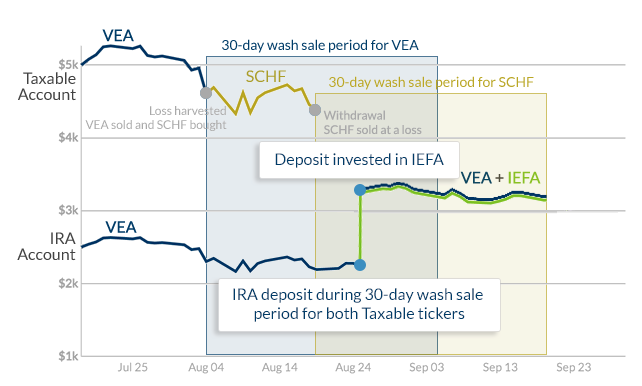

Read on to learn five important tax tips for NFT investors. If you sell a fund for a loss to tax-loss harvest it you may not re-buy a substantially identical fund for 30 days.

Betterment Review 2022 How It Works Pros And Cons And My Honest Opinion

The Internal Revenue Service IRS allows single filers and married couples filing jointly to deduct up to 3000 in realized losses from their.

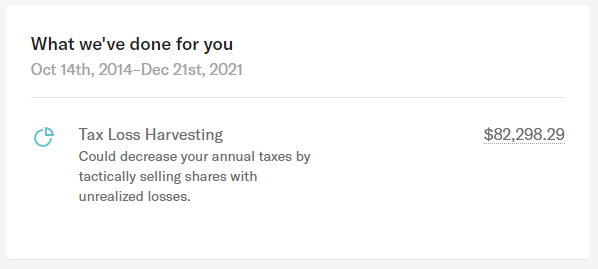

. The IRS knows this strategy can be used to generate substantial phantom tax losses by taxpayers. Click Edit beside the institution name. The strategy known as tax-loss harvesting allows you to sell declining assets from your brokerage account and use the losses to reduce other profits.

To claim a loss for tax purposes. Once losses exceed gains. Wash Sale Rule.

With crypto tokens wash sale rules dont apply meaning that you can sell your bitcoin and buy it right back whereas with a stock you would have to wait 30 days. Tax loss harvesting is the practice of selling a security that has experienced a loss. Tax Loss Harvesting the Wash Sale Rule.

The next evolution of tax-loss harvesting. Market action in the past couple of weeks has probably caused many investors to begin thinking about selling some securities to. The wash-sale rule stops investors from selling at a loss and buying the same time within a 61-day window as part of tax loss harvesting.

Click on the blue Jump to 1099-B link. By realizing or harvesting a loss investors are able to offset taxes on both gains and income. If you think about this rule it makes sense.

Improving legacy tax-loss harvesting. Click Edit beside each. 800 767-8040 Free Consultations Nationwide.

Tax-loss harvesting is when you sell a security at a loss for tax purposes. Traditional tax-loss harvesting strategies typically. The search results will give you an option to Jump to 1099-B.

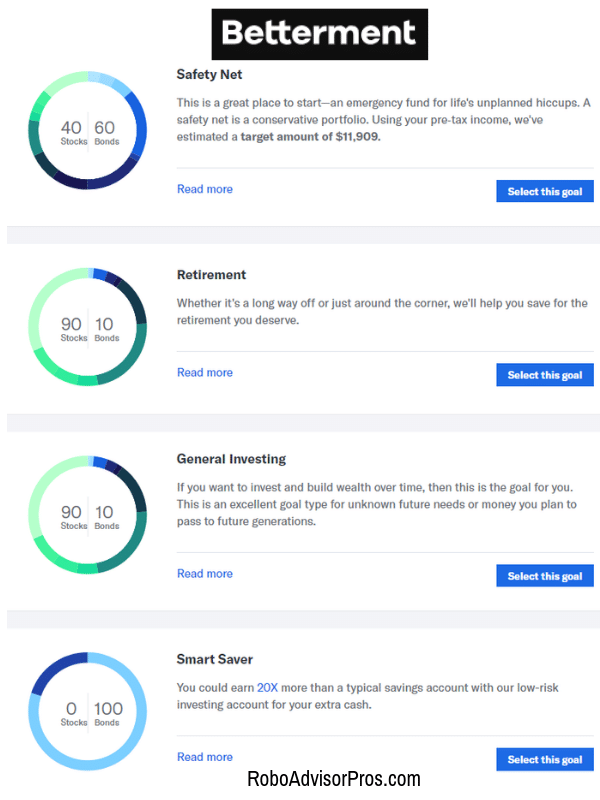

The algorithm implements this harvesting daily to maximize up to 3000 annual income deductions from harvested losses with further losses exceeding this amount carried. Help your clients prepare for tax season even if they dont plan on selling any NFTs this year.

Tax Loss Harvesting Methodology

Why Betterment Has Zero Of Our Dollars Go Curry Cracker

What Advisors Need To Know About Tax Loss Harvesting

Betterment Review Expert Guide And Analysis

Betterment Review 2022 Is Betterment Legit Betterment Fees Investmentzen

What Advisors Need To Know About Tax Loss Harvesting

Betterment Vs Wealthfront Guide Which Is Right For You Minafi

Top 5 Tax Loss Harvesting Tips Physician On Fire

Betterment Tax Loss Harvesting Review What You Should Know About The Betterment Tax Program Advisoryhq

/betterment-vs-vanguard-4f74415b96a34269b6671a8706391df0.jpeg)

Betterment Vs Vanguard Personal Advisor Services Which Is Best For You

A Detailed Review Of Betterment Returns Features And How It Works

Betterment Review Expert Guide And Analysis

Is Betterment Good For New Investors Yes Thanks To Low Fees And Easy Automatic Investing

A Detailed Review Of Betterment Returns Features And How It Works

Betterment Review Is This Robo Advisor Right For You

Betterment Review Is This Robo Advisor Right For You

Better Investing With Betterment

Betterment Slices Question Bogleheads Org

Betterment Tax Loss Harvesting Review What You Should Know About The Betterment Tax Program Advisoryhq